How to Determine Which Forecasting Model to Use Pro Forma

This information may be developed as part of the annual budgeting or forecasting process or it may be created as part of a specific request for cash flow information as may be required by a prospective lender or investor. Forecast next periods income statementestimate the percentage growth increase or decrease in sales cost of goods sold and other variable revenues and expenses and then.

Tire City Case Pro Forma Income Statements And Balance Sheets For 1996 1997 1 2 Page Project The Need For Fi Financial Health Tyre City Financial Statement

Instead of y α β x ϵ you now have y α β 1 x 1.

. A pro forma version of the equation. So you multiply your historical salaries of 200000 and your historical expenses of 100000 by 105 percent each. Look at balance sheets for an established firm in your industry as an example.

Multiply forecasted revenue by those percentages. To forecast future revenues take the previous years figure and multiply it by the growth rate. β n x n ϵ where n represents the number of predictors covariates in your model.

These financial statements projections are known financial modeling as Pro Forma financial statements. Assuming the growth will remain constant into the future we will use the same rate for 2017 2021. Make sure they agree by using the reconciliation equation.

Made or carried out in a perfunctory manner or as a formality. If we need to forecast our pro forma over multiple future periods say on a month-by-month basis over the next few years we use the exact same approach detailed above. The forecast or pro-forma balance.

Lets assume salaries and other expenses will increase by 5 percent. The formula used to calculate 2017 revenue is C7 1D5. The steps necessary to construct a pro forma balance sheet and a pro forma income statement and thus to determine the additional funds needed AFN are.

Pro forma cash flow is the estimated amount of cash inflows and outflows expected in one or more future periods. Pro Forma EPS Acquirers Net Income Targets Net Income Acquirers shares outstanding New Shares Issued 60003000 3000700 Pro Forma EMS will be. Pro forma definition.

It is called multiple linerar regression. Determine the type of model. Your pro forma balance sheet will have the same with another 4 years for a total of 5 years of projected information.

Through the process of creating a financial forecast by using examples offering insight and providing links to helpful third party resources. Apply the chosen model. Full PDF Package.

The proportion of earnings retained in the company. Financial Modeling and Pro Forma Analysis Short-Term Financial Planning. Weavers case we determined that this is 30.

The reason is that it is very useful and important to forecast how much financing a company will require in future years. When it comes to accounting pro forma statements are. Detailed assets liabilities and equity for 12 months.

Best practices suggest analyzing at least two periods worth of historical data so you would want to look at income statements from January 1 2018 and January 1 2019. We can use the formula C7-B7B7 to get this number. Select one or more forecasting models.

In this example the monthly trend rate would be 18112 or 015 or 15. You then figure your pro forma total expenses by adding. Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form.

And then the final step is we can use the pro forma income statement and pro forma balance sheets to construct a pro forma statement of cash flows. If youre developing a pro forma income statement for a one-year period beginning January 1 2020 youll want to look at historical data from the same period in previous years. A cash surplus the model simply add the surplus to the prior years ending cash balance to arrive at the end-of-period cash on the balance sheet.

Estimate your total liabilities and costs. We begin in Chapter 18 by developing the tools to forecast the cash flows. A pro-forma forecast similar to any sort of pro-forma report is not required to abide by GAAP.

If you do not know any modeling start with regression as it is most basic. Pro Forma is the sum of all earning divided by the sum of all shares outstanding to get Pro Forma EPS. Convert current costs into percentages of revenue 3.

Im gonna have to show you that on the next slide. Take notice of all the main elements. Accretion Dilution is the percentage in EPS after the transaction of before.

It is one minus the payout ratio. The first forecast that is computed with basic assumptions. In Part 7 we turn to the details of running the financial side of a corporation and focus on forecasting and short-term financial management.

To determine the average monthly trend rate simply divide the average annual trend rate by twelve. The first step of the process is to determine the amount by which sales are expected to increase. External financing needed as a company grows.

Your liabilities include loans and lines of credit. Based on financial assumptions or projections. Please consider that throughout this document a financial forecast will also be referred to as Financial Projections Financial Model and Pro Forma Financials.

Step three is we can use forecasted sales to construct a pro forma balance sheet. Calculatethe estimatedrevenue projections for your business this is called pro formaforecasting. The projections are achieved by using historical sales accounting data and assumptions on future sales and costs.

Click to see full answer. As a result they often reflect the best-case scenario which the. While the growth was faster in some months and slower in others it is appropriate here to simply look at the overall average growth.

Monitor and control the model. According to Merriam-Webster pro forma means. To prepare your pro forma income statement youll need to determine your estimated revenue projections.

So lets talk about how to project the balance sheet. Financial modeling takes the financial forecasts and builds a predictive model that helps a. Still you may want to know how to create a pro forma income statementby hand.

Accounts Receivable Days Average AR Sales Revenue x 365. After this use your costs and revenue projections to find out what your future net income might be. A cash deficit the model uses the revolver as a plug such that any cash losses lead to additional borrowing.

Financial forecasting is the process in which a company determines the expectations of future results. Forecast revenue for each month based on percentage growth 2. Determine the forecast horizon.

Then estimate all of your costs and liabilities such as loans rent payroll taxes etc. Your pro forma salaries for next year will be 210000 and your pro forma expenses will be 105000. Tap card to see definition.

Using the formula for their respective days outstanding we can forecast future accounts receivables inventory and accounts payables. The following are the formulas for annual days outstanding.

Pro Forma Income Statement Example Elegant Free Downloadable Excel Pro Forma In E Statement For Statement Template Financial Statement Income Statement

Expense Income Budget Forecasting Accounting Basics Financial Budget

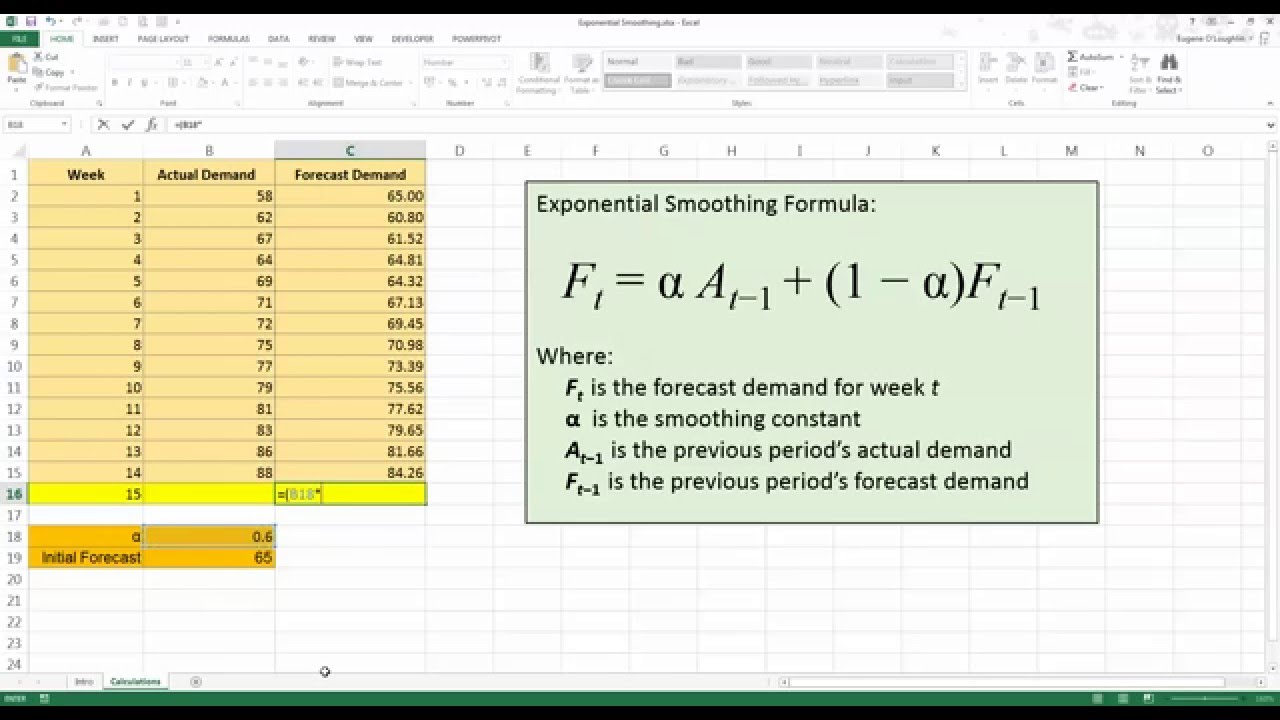

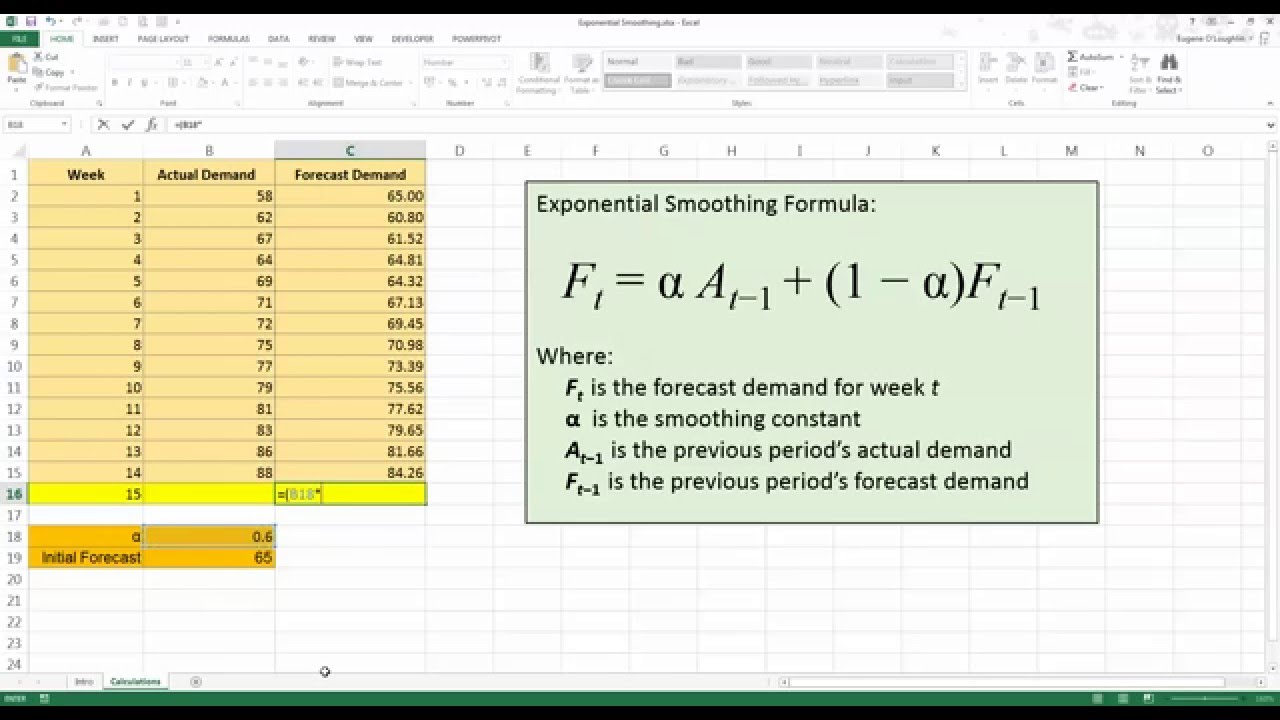

How To Forecast Using Exponential Smoothing In Excel 2013 Youtube

No comments for "How to Determine Which Forecasting Model to Use Pro Forma"

Post a Comment